City-Wide Property Revaluation

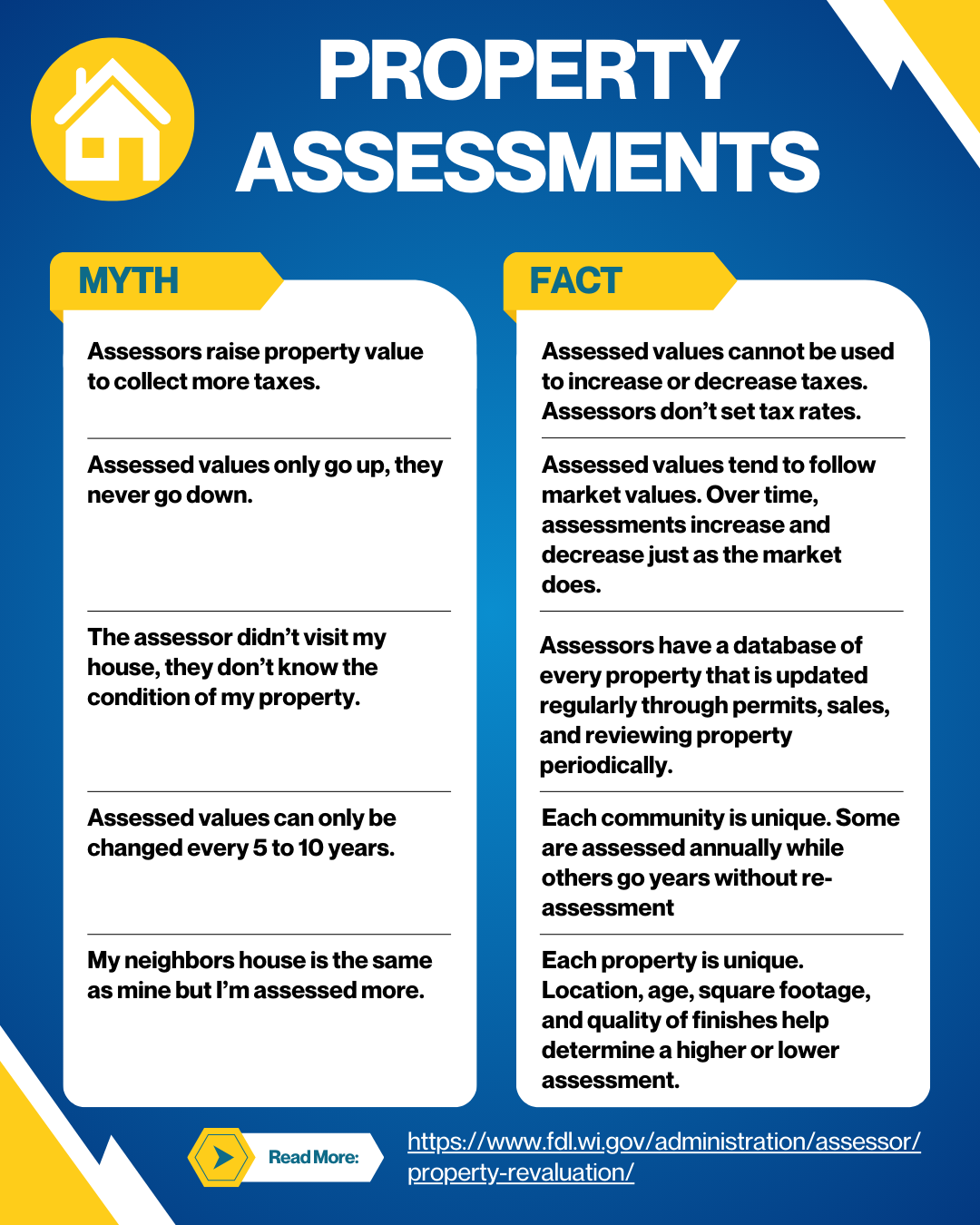

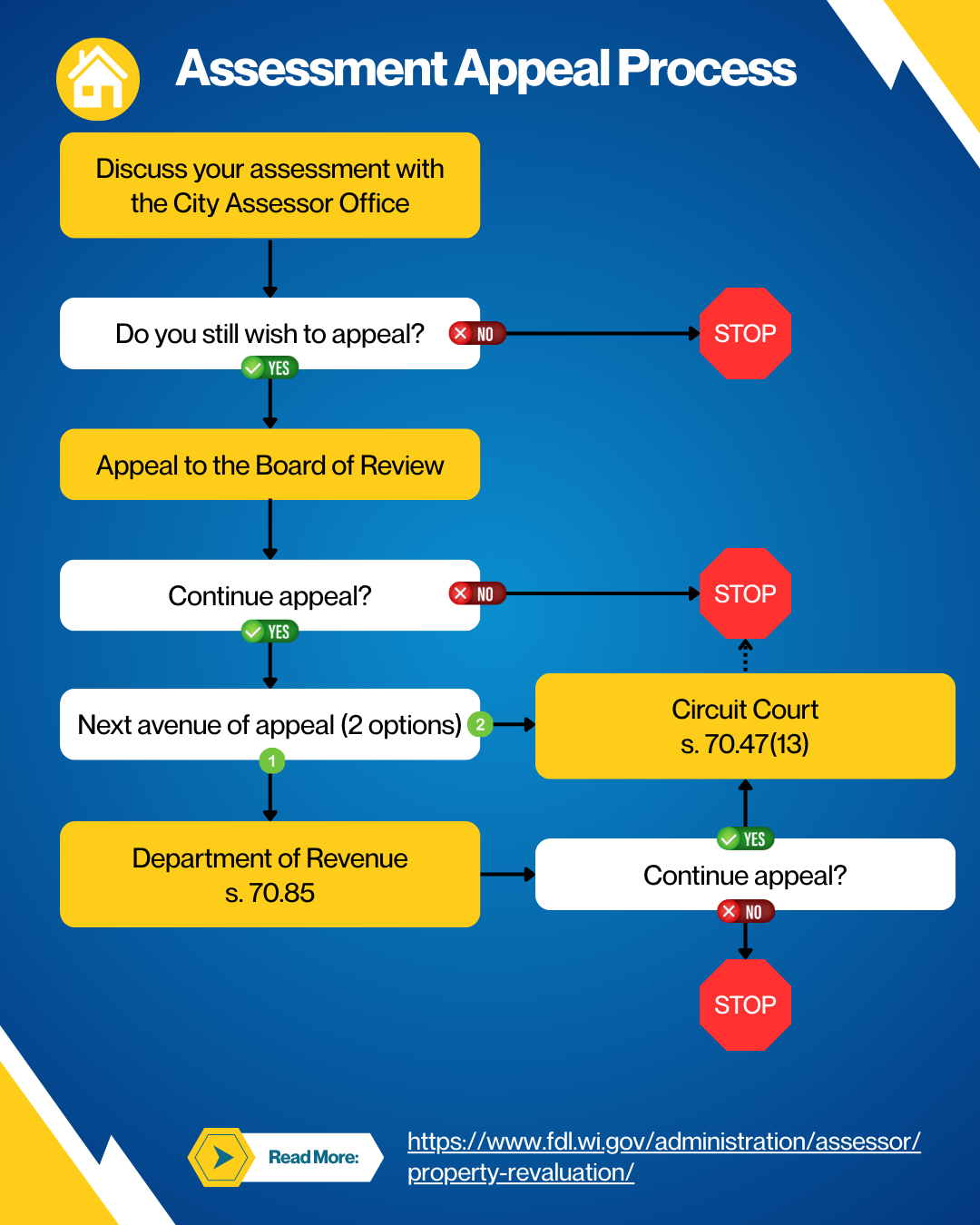

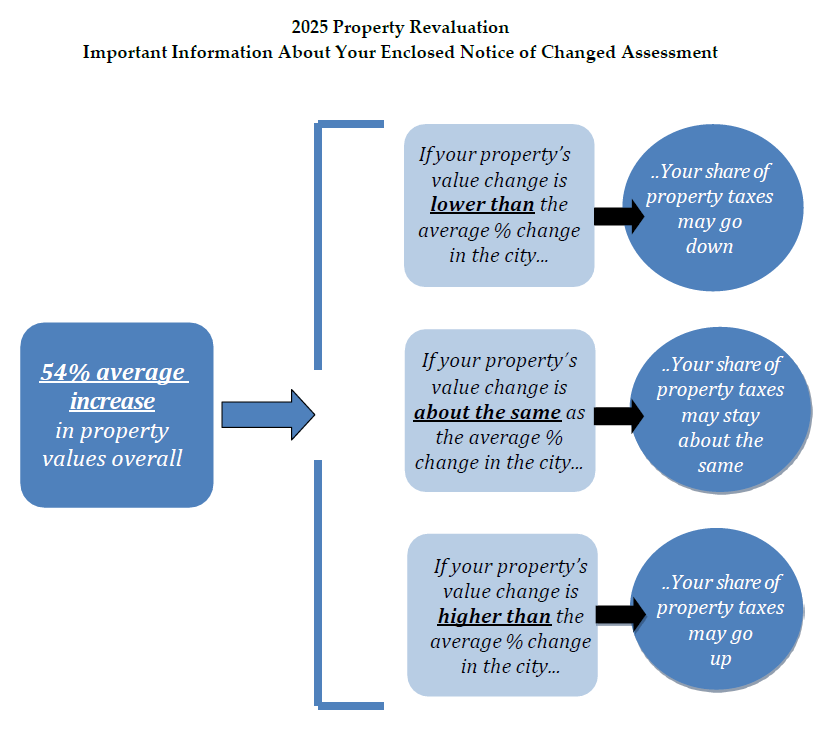

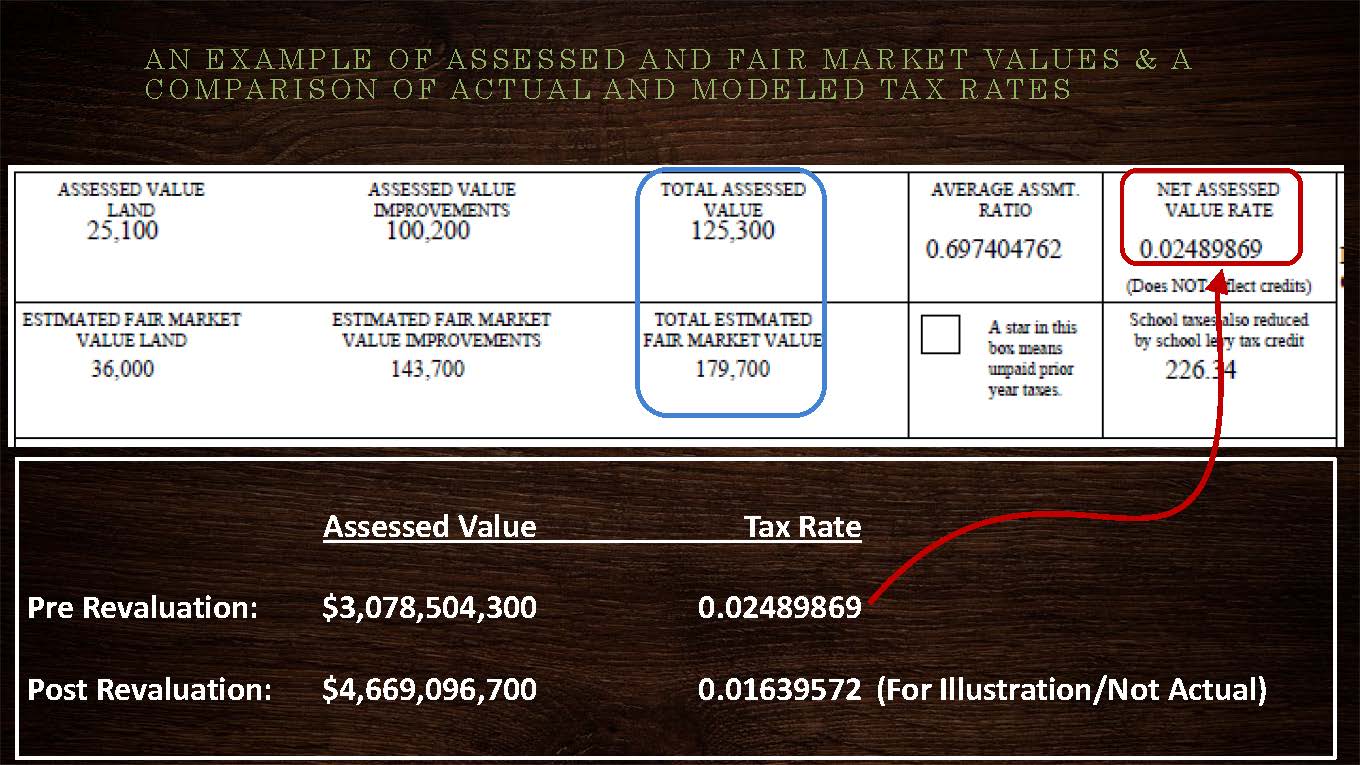

As our city continues to grow and evolve, it’s important that property assessments keep pace with changing market conditions. To ensure fairness in property taxation, the City of Fond du Lac is conducting a city-wide property revaluation for the 2025 assessment year. This process, while routine, can lead to many questions and concerns among property owners. Please review the common questions to learn about the revaluation and how it affects you.

While a city-wide property revaluation can be a complex and sometimes stressful process, it is a necessary step to ensure that property taxes are distributed fairly. By understanding how the process works and what to expect, the community can navigate this change with confidence.